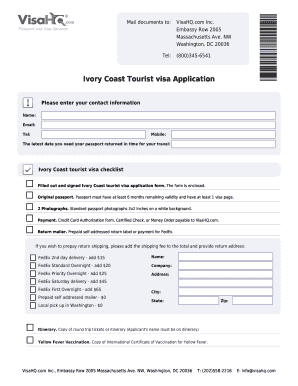

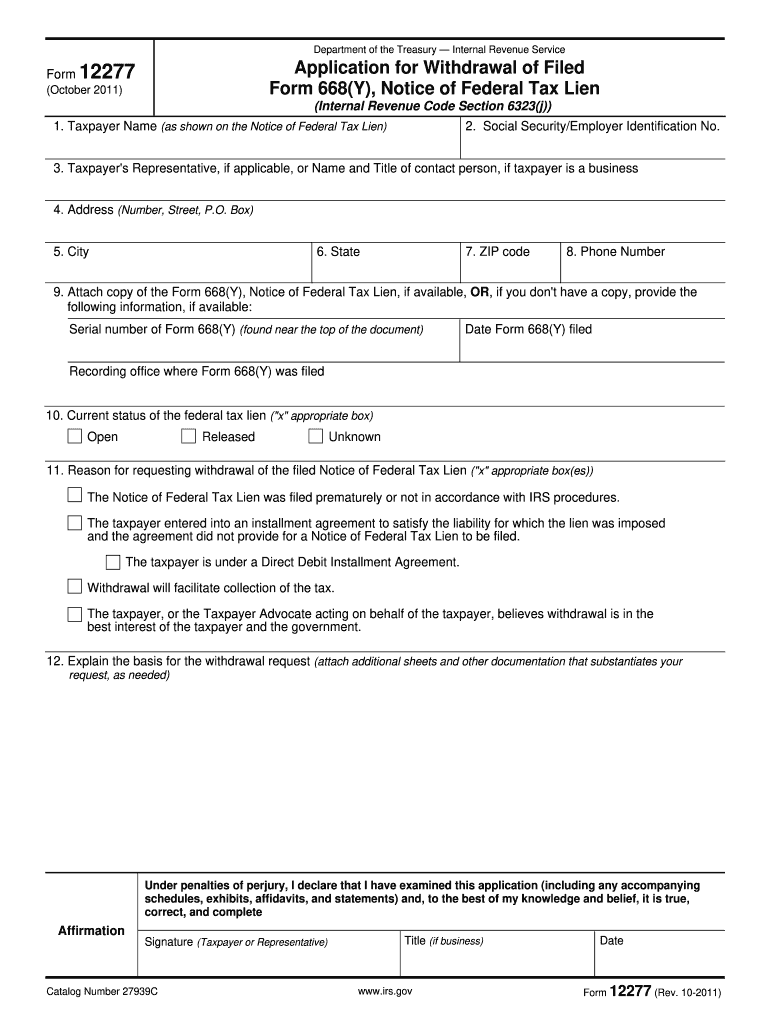

IRS 12277 2011-2026 free printable template

Instructions and Help about IRS 12277

How to edit IRS 12277

How to fill out IRS 12277

Latest updates to IRS 12277

All You Need to Know About IRS 12277

What is IRS 12277?

Who needs the form?

Components of the form

What information do you need when you file the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Where do I send the form?

FAQ about IRS 12277

What should I do if I need to correct a mistake on my IRS 12277?

If you need to correct a mistake on your IRS 12277, you should file an amended version of the form. Make sure to indicate the corrections clearly and keep a copy for your records. This will help ensure that the IRS processes the corrected information accurately.

How can I track the status of my IRS 12277 submission?

You can track the status of your IRS 12277 submission by using the IRS's online tools or contacting their customer service. It’s essential to have your details ready, including identification and submission dates, to verify the status effectively.

What should I do if my IRS 12277 e-file submission gets rejected?

If your IRS 12277 e-file submission is rejected, carefully review the rejection codes provided to understand the reasons. Correct any errors noted, and resubmit the form as soon as possible to avoid delays in processing.

Are there any special considerations if I am filing IRS 12277 on behalf of someone else?

When filing an IRS 12277 on behalf of someone else, it's important to have the appropriate power of attorney (POA) documentation. This ensures that you are authorized to act on their behalf and submit the necessary forms effectively.

What common errors should I be aware of when filing IRS 12277?

Common errors when filing IRS 12277 include incorrect personal information, failure to sign the form, or omitting necessary documentation. Double-check all fields and ensure that your submission meets all requirements to avoid potential issues.