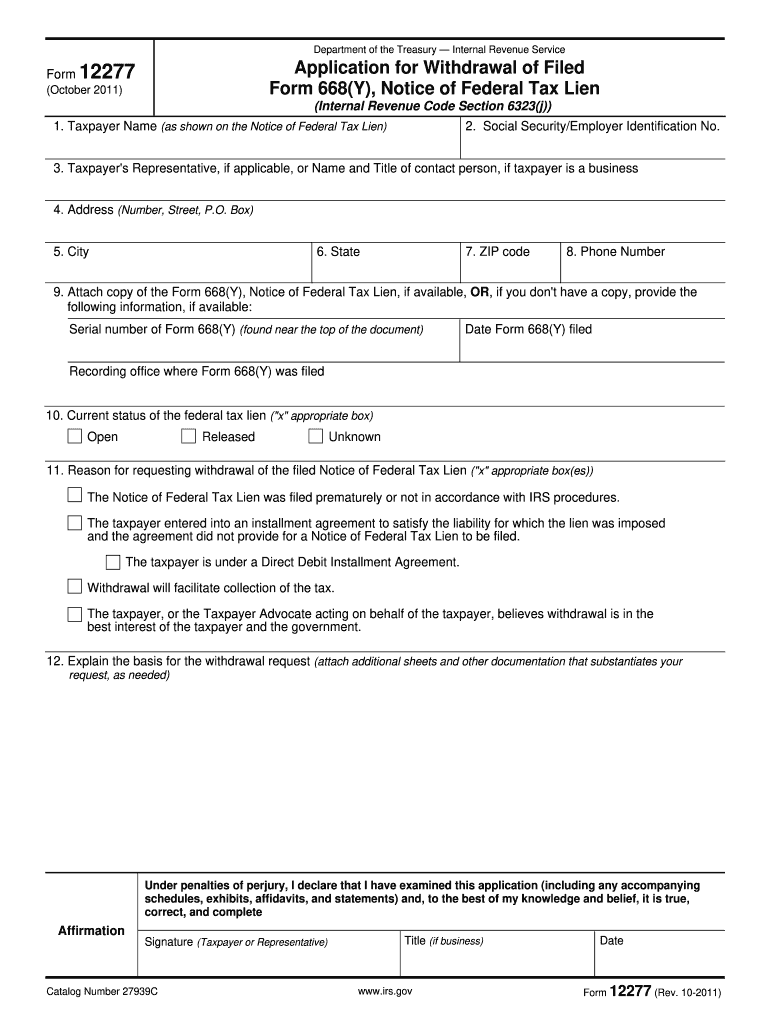

Who needs IRS Form 12277?

Form 12277 is the US Internal Revenue Service Form that is called Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien. Individuals should use it when they need to apply for withdrawal of a notice of federal tax lien, which is the government’s legal claim against the property of an individual who fails or refuses to pay their tax debts.

What is the purpose of the IRS Form 12277?

Completing the Application for Withdrawal of Filed Form 668 Y is the only accepted way to claim a lien withdrawal. The information this form has to provide will be used by the IRS to consider the claim and check up if there is enough reason to satisfy the claim.

Is Form 12277 accompanied by any other forms?

There isn’t a mandatory attachment required when filing the Withdrawal Application, yet to advance the claim consideration process, it is advisable to support the form by any statements or documents that can be relevant to the case.

Where do I send the completed IRS Form 12277?

When properly filled out, the Application for Withdrawal of Filed Form 668 Y must be submitted with the local IRS office.